Manufactured Home Information

Product Overview

Manufactured homes including modular, single-wide and multi-sectional mobile homes, any value, new or several years old, seasonal or vacant, located in a park or on private property.

Program Guides

Rental Mobile Home Information

Product Overview

For manufactured, mobile and modular homes, park models and permanently sited travel trailers that are rented to others for habitational use.

Program Guides

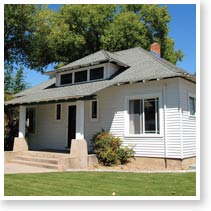

Dwelling Fire and Homeowners Information

Product Overview

Our Dwelling Fire and Specialty Homeowners programs are a solution for landlord, vacant, vacation rental, seasonal and primary homes. We offer Condominium insurance for landlord and vacant condos. Our broad underwriting accepts a wide range of customers, from customers or homes that may not qualify with other carriers all the way up to standard and preferred.

Program Guides

Motorcycle Information

Product Overview

The Foremost Motorcycle program offers coverage for custom or classic motorcycles, touring bikes, sport bikes, cruisers, trike conversions, imports, scooters and for low speed vehicles, such as neighborhood electric vehicles and golf carts, licensed or legally operated in Arizona, Oklahoma, South Carolina, Texas and California.

Program Guides

Off-Road Vehicle Information

Product Overview

Foremost has coverage available for off-road vehicles such as dirt bikes, dune buggies, golf carts, ATVs (3-, 4- and 6-wheel) and unlicensed neighborhood electric vehicles in Arizona, Texas and California.

Program Guides

Snowmobile Information

Product Overview

Foremost offers coverage for many popular snowmobile makes and models, including both standard and high-performance sleds.

Program Guides

Travel Trailer Information

Product Overview

For all conventional travel trailers including camping trailers, truck-mounted trailers and fifth-wheels. Coverage also available for stationary travel trailers and utility trailers designed to haul motorcycles, ATVs and other toys or animals.

Program Guides

Motor Home Information

Product Overview

For Class A, B and C motor homes, and all types of personal-use RVs including luxury motor coaches and vintage motor homes. Coverage also available for motor homes used as full-time residences.

Program Guides

Personal Watercraft Information

Product Overview

For one, two, or four passenger machines, sit-on or stand-up models.

Program Guides

Boat Information

Product Overview

For most types of watercraft including bass boats, cruisers, fishing boats, pontoons, runabouts, sailboats, catamarans, utility boats and personal watercraft.

Program Guides

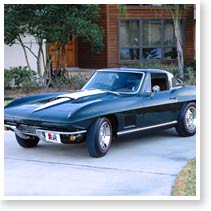

Collectible Auto Information

Product Overview

Foremost's program insures cars 25 years old and older that are considered antiques, muscle cars, and also cars considered modified, customs, exotics, kit cars and more!

J.C. Taylor (JCT) is the agency and underwriter for the Foremost collectible auto program. They provide agent service, handle commissions and contracts, billing, binding, and quoting. All policies are written on Foremost paper.

Program Guides

Quote Business

Online

You can quote collectible auto policies on JCTaylor.com/agents. The site provides quick quoting, electronic payment, secure e-signatures, photo and document upload capability, access to policy documents and your monthly commission statements, and more.

By Phone

Policy Service and Underwriting: 800-345-8290, fax: 610-853-0114

States available

Collectible auto insurance programs are available in all states except Hawaii. Physical damage coverage only is available in North Carolina. Special arrangements can even be made to insure vehicles on an overseas tour.

Please note that coverages and coverage amounts vary by state. All coverages may not be available in all areas.

Flood Information

Product Overview

Floods are the number one natural disaster in the United States, and the least-insured peril. Just a few inches of water could cost a homeowner thousands of dollars – and yet, most people don't realize their homeowners polices won't cover flood damage.

Why not make the Foremost Choice® for these customers? Foremost® offers flood insurance through the National Flood Insurance Program.

Get Started

- View the Foremost flood insurance quick start guide(Opens in a new window).

- Log onto ForemostFlood.com to obtain a quote, submit applications and learn more about flood insurance. Note: If you are a new user or you need additional password assistance, please contact NFS Agency Services at 866-796-7582 and identify yourself as a Foremost producer.

- Set up your agency with AL3/Ivans downloads(Opens in a new window).

Customer Benefits

- Coverage is available for homes or businesses.

- Anyone in a participating community can purchase flood insurance.

- Low-cost coverage is available for properties that are not in high-risk areas.

- Coverage is available for tenants as well as property owners.

- We can offer up to $250,000 of building coverage and $100,000 in personal property coverage.

Marketing Materials

- Foremost Supply Source – Get marketing materials to promote the Foremost flood program by calling 800-527-3905 or by visiting the Supply Source tab.

- NFIP marketing brochures – The NFIP offers a broad selection of free generic marketing materials (brochures, stuffers and information sheets). The order form for these supplies is available at: http://www.fema.gov(Opens in a new window).

- NFIP website – Agents.Floodsmart.gov contains information and marketing resources.

- Foremost Flood Insurance Waiver Form (Opens in a new window)

Flood Program Benefits and Facts

- Commissions: Start at 15% and can grow to 20%.

- Flood Bonus: Paid annually based on flood PIF/GWP growth.

- Higher homeowners retention rates: Overall rates have been 7-10 points higher with flood!

- Data and information can be received via an IVANS account for Flood.

- Dedicated support Mon - Fri, 8 am - 8 pm ET.

- Rollover assistance.

- 24/7 claims reporting.

- Rates for all companies are set by federal government, so it's a level playing field.

- Coverage is available in all 50 states (Note: Flooding events have occurred in all 50 states and 98% of counties in the U.S.).

- Coastal counties account for 39% of the total U.S. population.

- Just because a home lender doesn't require flood insurance doesn't mean the dwelling isn't at risk of flooding. In most cases, it can take 30 days after purchase for a flood policy to take effect.

Learn More About Flood Insurance

- ForemostFlood.com (Opens in a new window) (obtain quotes, submit applications and learn more about Flood insurance)

- Foremost Flood Processing Center: 800-260-9270 (policy service, underwriting and claims)

- Foremost Flood Marketing Department: 818-876-3474

Some Flood Facts from Fema.gov, noaa.gov, and floodsmart.gov – 2020. Not all products, coverages and discounts are available in all areas. Foremost Flood insurance policies are underwritten by the National Flood Insurance Program (NFIP), a sub-agency within the Federal Emergency Management Agency (FEMA).